Understanding Shareholder Changes in Nepal

A shareholder change in Nepal refers to the transfer of ownership rights in a company from one individual or entity to another. This process involves altering the company’s ownership structure by selling, transferring, or reallocating shares. Shareholder changes can occur for various reasons, such as investment opportunities, business restructuring, or ownership succession. In Nepal, this process is regulated to ensure transparency and compliance with local business laws.

The Governing Authority for Shareholder Changes

Office of Company Registrar (OCR)

The Office of Company Registrar (OCR) is the primary authority responsible for handling shareholder changes in Nepal. As a government body under the Ministry of Industry, Commerce, and Supplies, the OCR oversees company registrations, modifications, and dissolutions. For shareholder changes, companies must submit the required documentation and obtain approval from the OCR to ensure the legality and proper recording of the ownership transfer.

Legal Framework Governing Shareholder Changes

Companies Act 2063 (2006)

The primary law governing shareholder changes in Nepal is the Companies Act 2063 (2006). This act provides the legal framework for company operations, including provisions for share transfers and ownership changes. Key sections of the act detail the procedures for transferring shares, maintaining shareholder registers, and updating company documents to reflect ownership changes.

Securities Act 2063 (2007)

For public companies listed on the Nepal Stock Exchange, the Securities Act 2063 (2007) also plays a role in regulating shareholder changes. This act ensures fair trading practices and transparency in share transactions for publicly traded companies.

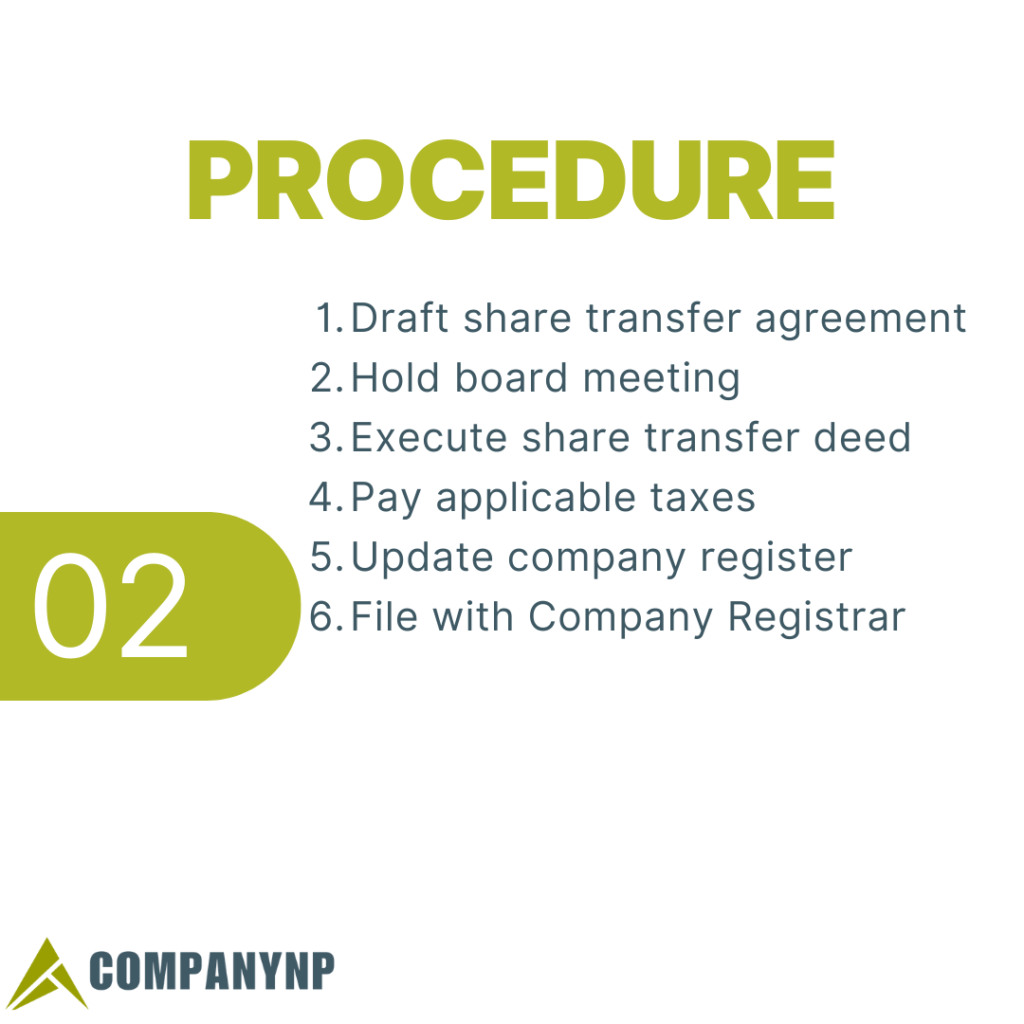

The Process of Changing Company Shareholders

The process of changing company shareholders in Nepal involves several steps to ensure legal compliance and proper documentation. Here’s a detailed breakdown of the process:

- Board Resolution: The company’s board of directors must pass a resolution approving the proposed shareholder change. This resolution should clearly state the details of the share transfer, including the names of the transferor and transferee, the number of shares being transferred, and the agreed-upon price.

- Share Transfer Agreement: A formal share transfer agreement must be drafted and signed by both the transferor (current shareholder) and the transferee (new shareholder). This agreement outlines the terms and conditions of the share transfer.

- Share Certificate Endorsement: The physical share certificates must be endorsed by the transferor, indicating the transfer of ownership to the new shareholder.

- Document Preparation: Gather all required documents, including the board resolution, share transfer agreement, endorsed share certificates, and any other supporting documents required by the OCR.

- OCR Submission: Submit the complete set of documents to the Office of Company Registrar for review and approval.

- OCR Review: The OCR will review the submitted documents to ensure compliance with legal requirements and company regulations.

- Approval and Recording: Once approved, the OCR will record the shareholder change in their official records and issue a certificate of confirmation.

This process typically takes 2-4 weeks, depending on the complexity of the transfer and the completeness of the submitted documents. It’s crucial to follow each step carefully to avoid delays or rejections in the shareholder change process.

Read More:

Foreign Shareholder Approval Process in Nepal

Company Conversion Process in Nepal

Joint Venture Agreement Registration Process in Nepal

Required Documents for Shareholder Change

To successfully complete a shareholder change in Nepal, companies must prepare and submit the following documents:

- Board resolution approving the share transfer

- Share transfer agreement signed by both parties

- Endorsed share certificates

- Updated shareholder register

- Company’s Articles of Association and Memorandum

- Tax clearance certificate

- Citizenship certificates or passport copies of involved parties

Timeframe for Shareholder Change Process

Processing Time at OCR

The shareholder change process in Nepal typically takes between 2 to 4 weeks to complete. However, this timeline can vary depending on several factors:

- Completeness of submitted documents

- Complexity of the share transfer

- Current workload of the OCR

- Any additional inquiries or clarifications required by the OCR

To ensure a smooth and timely process, it’s crucial to submit all required documents accurately and promptly respond to any requests for additional information from the OCR.

Costs Associated with Changing Company Shareholders

Government Fees and Professional Charges

The costs involved in changing company shareholders in Nepal can be divided into two main categories:

- Government Fees:

- OCR filing fees

- Share transfer stamp duty

- Tax clearance certificate fees

- Professional Charges:

- Legal fees for document preparation

- Accounting fees for financial statement updates

- Company secretary fees for regulatory compliance

The exact costs can vary depending on the company’s size, the number of shares being transferred, and the complexity of the transaction. It’s advisable to consult with a legal or financial professional to get an accurate estimate of the total costs involved in your specific shareholder change process.

Post-Change Requirements for Companies

After completing the shareholder change process, companies in Nepal must fulfill several post-change requirements to maintain compliance:

- Update internal records and shareholder register

- Issue new share certificates to the new shareholders

- File annual returns reflecting the new ownership structure

- Update company information with relevant authorities

- Inform banks and financial institutions of the ownership change

- Review and update signatory authorities if necessary

- Comply with any sector-specific regulatory requirements

Restrictions on Shareholder Changes

Legal and Regulatory Limitations

While shareholder changes are generally allowed in Nepal, there are some restrictions and limitations to be aware of:

- Foreign Investment Restrictions: Certain sectors have limitations on foreign ownership percentages.

- Minimum Shareholding Requirements: Some company types require a minimum number of shareholders.

- Lock-in Periods: Newly formed companies may have restrictions on share transfers for a specified period.

- Preferential Rights: Existing shareholders may have first right of refusal for share transfers.

It’s important to consult with legal experts to ensure compliance with these restrictions before initiating a shareholder change process.

Implications of Changing Company Shareholders

Business and Legal Consequences

Changing company shareholders in Nepal can have several implications for the business:

- Change in company control and decision-making

- Potential shifts in business strategy and direction

- Impact on existing contracts and agreements

- Changes in tax liability and financial obligations

- Possible restructuring of the board of directors

- Alterations to company policies and procedures

- Effects on employee morale and stakeholder relationships

Understanding these implications is crucial for both the existing and new shareholders to ensure a smooth transition and continued business success.

In conclusion, the shareholder change process in Nepal involves several steps and requires careful attention to legal and regulatory requirements.

Contents

- 1 Understanding Shareholder Changes in Nepal

- 2 The Governing Authority for Shareholder Changes

- 3 Legal Framework Governing Shareholder Changes

- 4 The Process of Changing Company Shareholders

- 5 Required Documents for Shareholder Change

- 6 Timeframe for Shareholder Change Process

- 7 Costs Associated with Changing Company Shareholders

- 8 Post-Change Requirements for Companies

- 9 Restrictions on Shareholder Changes

- 10 Implications of Changing Company Shareholders