Business plan drafting in Nepal is a crucial process for entrepreneurs and companies seeking to establish or expand their operations in the country. A well-crafted business plan serves as a roadmap for success, outlining the company’s objectives, strategies, and financial projections. In Nepal, the importance of business planning has gained significant recognition in recent years, particularly as the nation strives to attract foreign investment and promote economic growth.

The Companies Act 2063 (2006) of Nepal provides the legal framework for company registration and operation. While the Act does not explicitly mandate the creation of a business plan, it does require companies to submit various documents that essentially form the components of a comprehensive business plan. This includes details about the company’s objectives, capital structure, and management, which are all integral parts of a well-structured business plan.

Key Components of a Business Plan

A robust business plan in Nepal typically includes the following key components:

- Executive Summary

- Company Description

- Market Analysis

- Organization and Management

- Products or Services

- Marketing and Sales Strategy

- Funding Requirements

- Financial Projections

- Appendices

These components align with international best practices and also satisfy the requirements set forth by various Nepali regulatory bodies, including the Office of Company Registrar and the Department of Industry.

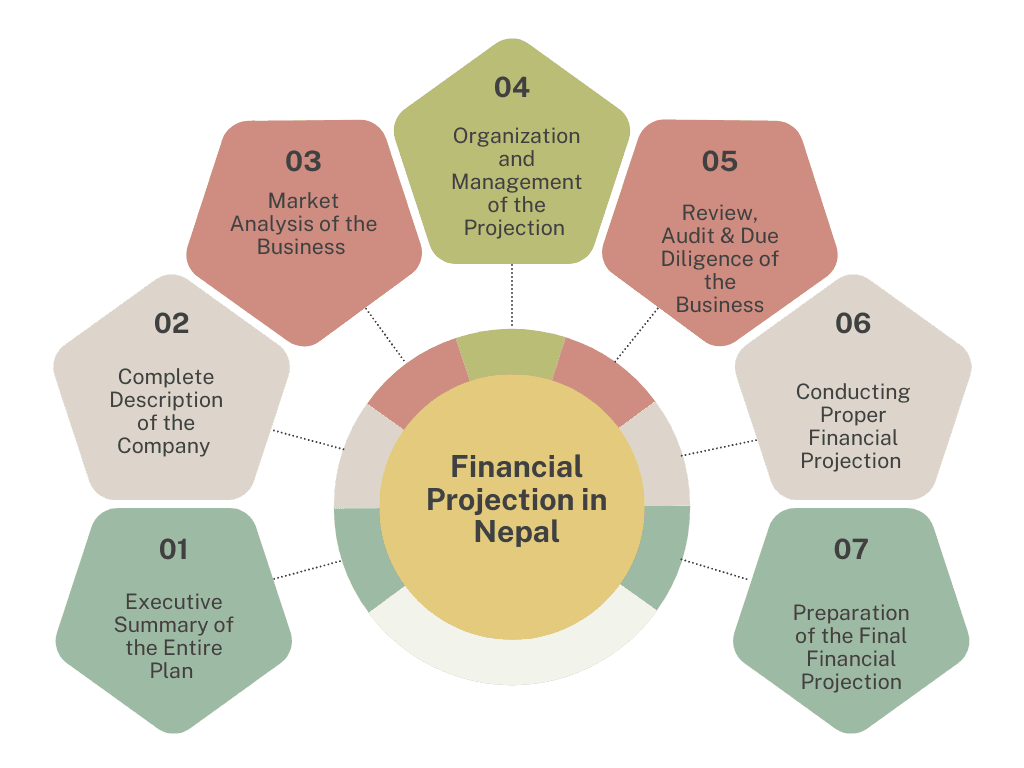

Financial Projection in Nepal: A Complete Guide

- Step 1: Executive Summary of the Entire Plan

- Step 2: Complete Description of the Company

- Step 3: Market Analysis of the Business

- Step 4: Organization and Management of the Projection

- Step 5: Review, Audit & Due Diligence of the Business

- Step 6: Conducting Proper Financial Projection

- Step 7: Preparation of the Final Financial Projection

A. Step 1: Executive Summary

The executive summary is a concise overview of the entire business plan. In Nepal, this section should highlight the company’s unique value proposition and its alignment with national economic priorities, as outlined in the Nepal Investment Guide 2021.

B. Step 2: Company Description

This section provides detailed information about the company, including its legal structure, ownership, and registration details. In Nepal, companies must be registered under the Companies Act 2063 (2006), and the description should include the company’s registration number and date of incorporation.

C. Step 3: Market Analysis

A thorough market analysis is crucial for businesses operating in Nepal. This should include an assessment of the target market, competitor analysis, and industry trends. The Industrial Enterprise Act 2076 (2020) provides guidelines on industry classifications, which should be considered when conducting market analysis.

D. Step 4: Organization and Management

This section outlines the company’s organizational structure and management team. In Nepal, the Companies Act 2063 (2006) stipulates certain requirements for company directors and officers, which should be reflected in this section.

E. Step 5: Financial Projections

Financial projections are a critical component of any business plan. In Nepal, these projections should adhere to the Nepal Financial Reporting Standards (NFRS) and consider tax implications as per the Income Tax Act 2058 (2002).

IV. Documents Required for Business Plan

When drafting a business plan in Nepal, the following documents are typically required:

- Company Registration Certificate

- PAN (Permanent Account Number) Certificate

- Memorandum of Association

- Articles of Association

- Board Resolution (if applicable)

- Audited Financial Statements (for existing businesses)

- Tax Clearance Certificate

- Industry Registration Certificate (if applicable)

These documents are not only essential for the business plan but also for various regulatory compliance requirements in Nepal.

V. Business Plan Drafting Services

In Nepal, several professional services offer business plan drafting assistance. These include:

- Management Consulting Firms

- Chartered Accountants

- Legal Advisory Services

- Business Incubators and Accelerators

The Institute of Chartered Accountants of Nepal (ICAN) and the Nepal Bar Association can provide references for qualified professionals who offer business plan drafting services.

VI. Typical Timeframe for Business Plan Creation

The timeframe for creating a comprehensive business plan in Nepal can vary depending on the complexity of the business and the availability of required information. Typically, the process may take anywhere from 2 to 8 weeks. This timeline should account for the following stages:

- Information Gathering: 1-2 weeks

- Draft Preparation: 1-3 weeks

- Review and Revisions: 1-2 weeks

- Finalization: 1 week

It’s important to note that certain regulatory approvals, such as those required by the Department of Industry for specific sectors, may extend this timeline.

VII. Costs Associated with Business Plan Drafting

The costs of drafting a business plan in Nepal can vary widely based on the complexity of the business and the level of professional assistance required. Typical costs may include:

- Professional Fees: NPR 50,000 – NPR 500,000

- Market Research Costs: NPR 20,000 – NPR 200,000

- Financial Modeling Software: NPR 10,000 – NPR 50,000

- Printing and Binding: NPR 5,000 – NPR 20,000

These costs are estimates and can vary significantly. It’s advisable to obtain quotes from multiple service providers to ensure competitive pricing.

VIII. Relevant Laws and Best Practices

When drafting a business plan in Nepal, it’s crucial to consider the following laws and regulations:

- Companies Act 2063 (2006)

- Industrial Enterprise Act 2076 (2020)

- Foreign Investment and Technology Transfer Act 2075 (2019)

- Income Tax Act 2058 (2002)

- Labor Act 2074 (2017)

Best practices for business plan drafting in Nepal include:

- Aligning the plan with national economic priorities

- Incorporating sustainable development goals

- Addressing potential environmental impacts

- Considering corporate social responsibility initiatives

IX. Business Planning Practices in Nepal

Business planning practices in Nepal have evolved significantly in recent years, influenced by both international standards and local regulatory requirements. The Nepal Rastra Bank, the country’s central bank, has played a crucial role in promoting sound business planning practices, particularly in the financial sector.

For small and medium enterprises (SMEs), the Small and Medium Enterprises Development Fund (SMEDF) provides guidelines and support for business planning. These guidelines emphasize the importance of financial literacy and proper record-keeping, which are essential for creating accurate and reliable business plans.

In the technology sector, the Information Technology Park in Banepa has been instrumental in fostering a culture of innovation and strategic planning among tech startups. This has led to an increased focus on scalable business models and detailed market analysis in business plans within the IT sector.

The Nepal Investment Board, established under the Investment Board Nepal Act 2068 (2011), has also contributed to raising the standards of business planning in the country, particularly for large-scale projects and foreign investments. Their guidelines often require comprehensive feasibility studies and detailed project plans, which have indirectly influenced business planning practices across various sectors.

X. Conclusion

Business plan drafting in Nepal is a critical process that requires careful consideration of local laws, market conditions, and regulatory requirements. A well-crafted business plan not only serves as a roadmap for the company but also plays a crucial role in securing funding, attracting investors, and ensuring compliance with Nepali regulations.

As Nepal continues to develop its economy and attract both domestic and foreign investment, the importance of robust business planning cannot be overstated. Entrepreneurs and businesses operating in Nepal should leverage professional services when necessary and stay informed about the latest regulatory changes and market trends to create effective and compliant business plans.

By following the guidelines outlined in this comprehensive guide and adhering to relevant laws and best practices, businesses can create strong foundations for success in the Nepali market. As the business landscape in Nepal continues to evolve, so too will the practices and requirements for business plan drafting, making it essential for entrepreneurs and companies to stay informed and adaptable.

FAQs

What is a business plan?

A business plan in Nepal is a comprehensive document that outlines a company’s objectives, strategies, market analysis, financial projections, and operational details. In Nepal, while not explicitly required by law, a business plan is often necessary for company registration, securing funding, and strategic planning.

Who needs a business plan in Nepal?

Startups seeking investment

Existing businesses planning expansion

Companies applying for loans from financial institutions

Foreign investors entering the Nepali market

Businesses in regulated industries requiring government approvals

How long should a business plan be?

The length of a business plan can vary depending on the complexity of the business and its intended use. In Nepal, a typical business plan ranges from 20 to 50 pages, including financial projections and appendices. However, for certain regulatory submissions, such as those required by the Department of Industry, more detailed plans may be necessary.

What financial projections should be included?

Financial projections in a Nepali business plan should typically include:

Income Statement (Profit and Loss Statement)

Balance Sheet

Cash Flow Statement

Break-even Analysis

Sales Forecast

These projections should cover at least 3-5 years and adhere to the Nepal Financial Reporting Standards (NFRS).

Is a business plan legally required in Nepal?

While a formal business plan is not explicitly required by law for all businesses in Nepal, certain components of a business plan are necessary for company registration and regulatory compliance. For example, the Companies Act 2063 (2006) requires submission of a Memorandum of Association and Articles of Association, which contain elements typically found in a business plan.

Can I write my own business plan in Nepal?

Yes, it is possible to write your own business plan in Nepal. However, given the complexity of local regulations and market conditions, it’s often advisable to seek professional assistance, especially for critical sections like financial projections and legal compliance. The Small and Medium Enterprises Development Fund (SMEDF) and various business incubators in Nepal offer resources and guidance for entrepreneurs looking to draft their own business plans.

Companies Required for VAT Registration in Nepal | Rental Agreement in Nepal in English and Nepali | Register a HR Job Agency in Nepal

Contents

- 1 Key Components of a Business Plan

- 2 Financial Projection in Nepal: A Complete Guide

- 3 IV. Documents Required for Business Plan

- 4 V. Business Plan Drafting Services

- 5 VI. Typical Timeframe for Business Plan Creation

- 6 VII. Costs Associated with Business Plan Drafting

- 7 VIII. Relevant Laws and Best Practices

- 8 IX. Business Planning Practices in Nepal

- 9 X. Conclusion

- 10 FAQs