Learn about company registration fees in Nepal, including government charges, legal costs, and additional expenses. Understand the complete fee structure for registering a private limited, public limited, or foreign company in Nepal.

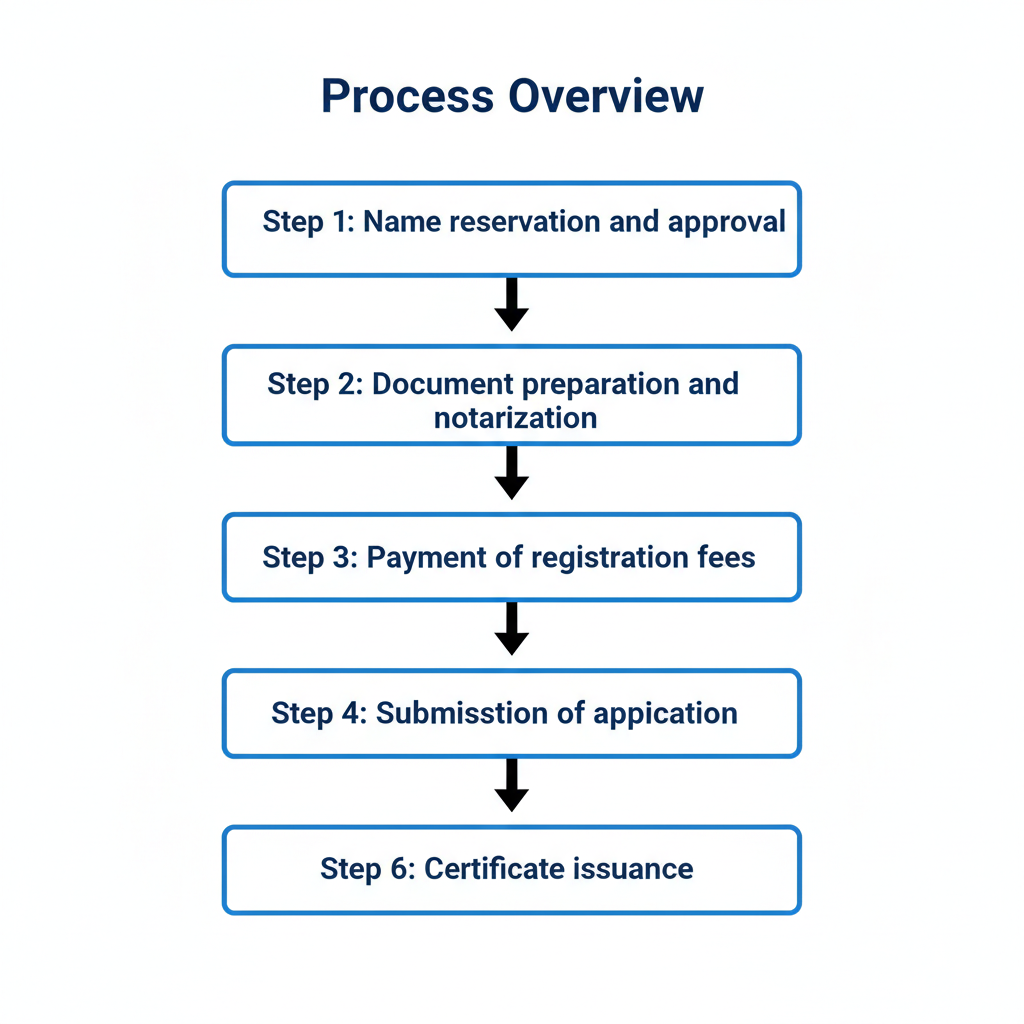

Process Overview

- Step 1: Name reservation and approval

- Step 2: Document preparation and notarization

- Step 3: Payment of registration fees

- Step 4: Submission of application

- Step 5: Verification and approval

- Step 6: Certificate issuance

What Is Company Registration Fee in Nepal?

Company registration fees in Nepal refer to the mandatory charges payable to the Office of Company Registrar (OCR) and other government authorities for incorporating a business entity under the Companies Act, 2063 (2006). These fees vary based on the type of company, authorized capital, and nature of business activities. The fee structure includes government registration charges, name reservation fees, publication costs, and administrative expenses.

The company registration fees in Nepal are determined by the authorized capital declared in the Memorandum of Association. Higher authorized capital attracts proportionally higher registration fees. The Companies Act, 2063 and the Companies Regulations, 2064 (2007) provide the legal framework for calculating these fees. The Office of Company Registrar collects these fees as revenue for the Government of Nepal.

Understanding company registration fees in Nepal is essential for entrepreneurs and investors planning to establish a business. The total cost includes not only government fees but also professional charges for legal documentation, translation services, and consultancy. Proper budgeting for these expenses ensures smooth company incorporation without financial surprises during the registration process.

Where to Register a Company in Nepal?

Company registration in Nepal must be completed at the Office of Company Registrar (OCR), located in Tripureshwor, Kathmandu. The OCR operates under the Ministry of Industry, Commerce and Supplies and serves as the central authority for all company-related registrations, filings, and compliance matters. Branch offices exist in provincial capitals, but the main office in Kathmandu handles most registrations.

The Office of Company Registrar maintains a comprehensive database of all registered companies in Nepal. Applicants must physically visit the office or use the online portal for submission of documents and payment of company registration fees in Nepal. The office provides information counters and help desks to assist applicants with the registration process and fee calculation.

For online services, the OCR has developed a digital platform accessible at https://www.ocr.gov.np. This portal allows applicants to check name availability, download forms, and track application status. However, physical submission of original documents and payment of company registration fees in Nepal still requires visiting the office. The OCR operates during regular government office hours from Sunday to Friday.

What Laws Govern Company Registration Fees in Nepal?

The legal framework governing company registration fees in Nepal consists of several statutes and regulations that define the fee structure, payment procedures, and compliance requirements.

- Companies Act, 2063 (2006) – Primary legislation governing company incorporation and registration

- Companies Regulations, 2064 (2007) – Detailed rules for registration procedures and fee calculation

- Industrial Enterprises Act, 2076 (2020) – Provisions for industrial company registration

- Foreign Investment and Technology Transfer Act, 2075 (2019) – Requirements for foreign company registration

- Income Tax Act, 2058 (2002) – Tax registration and PAN requirements

- Value Added Tax Act, 2052 (1996) – VAT registration obligations

- Labor Act, 2074 (2017) – Employee-related compliance costs

- Social Security Act, 2074 (2017) – Social security registration fees

How to Calculate Company Registration Fees in Nepal?

Step 1: Determine Company Type and Authorized Capital

The first step in calculating company registration fees in Nepal involves identifying the type of company you wish to register—private limited, public limited, or foreign branch office. The authorized capital amount declared in the Memorandum of Association directly impacts the registration fee calculation under the Companies Regulations, 2064.

Step 2: Calculate Base Registration Fee

The base registration fee is calculated as 0.1% of the authorized capital for private limited companies and 0.05% for public limited companies. The minimum fee is NPR 1,000 and the maximum is NPR 100,000 for private companies. This calculation forms the primary component of company registration fees in Nepal.

Step 3: Add Name Reservation Fee

Name reservation requires payment of NPR 100 for checking name availability and NPR 500 for reserving the approved name. This fee must be paid before submitting the main registration application. The name reservation remains valid for 35 days from the date of approval by the Office of Company Registrar.

Step 4: Include Publication Charges

Publication of company registration notice in the Nepal Gazette costs NPR 600. Additionally, publication in a national daily newspaper requires approximately NPR 2,000 to NPR 5,000 depending on the newspaper selected. These publication charges are mandatory components of company registration fees in Nepal under the Companies Act, 2063.

Step 5: Add Administrative and Processing Fees

Administrative fees include document verification charges of NPR 500, certificate issuance fee of NPR 1,000, and seal preparation cost of NPR 500. The Office of Company Registrar also charges NPR 200 for providing certified copies of registration documents. These miscellaneous charges contribute to the total company registration fees in Nepal.

Step 6: Calculate Professional Service Charges

Professional fees for legal documentation, translation services, and consultancy typically range from NPR 15,000 to NPR 50,000 depending on company complexity. Notarization of documents costs approximately NPR 500 per document. These professional charges, while not government fees, form part of the overall company registration fees in Nepal that entrepreneurs must budget for.

What Documents Are Required for Company Registration?

- Citizenship certificates of all shareholders and directors (notarized copies)

- Passport-size photographs of shareholders and directors (4 copies each)

- PAN registration certificates of all shareholders and directors

- Memorandum of Association (in prescribed format)

- Articles of Association (in prescribed format)

- Consent letters from all directors accepting their appointment

- Registered office address proof (rental agreement or ownership certificate)

- Name reservation approval letter from OCR

- Bank account opening recommendation letter

- Share distribution statement among shareholders

- Board resolution for company registration

- Power of attorney (if representative is filing application)

- Foreign investment approval (for foreign companies)

- Tax clearance certificates of shareholders

- Character certificates from local authorities

What Is the Fee Structure for Different Company Types?

The company registration fees in Nepal vary significantly based on the type of business entity being registered and the authorized capital declared.

| Company Type | Authorized Capital Range | Registration Fee | Minimum Fee | Maximum Fee |

|---|---|---|---|---|

| Private Limited Company | Up to NPR 1,000,000 | 0.1% of capital | NPR 1,000 | NPR 1,000 |

| Private Limited Company | NPR 1,000,001 to NPR 10,000,000 | 0.1% of capital | NPR 1,001 | NPR 10,000 |

| Private Limited Company | NPR 10,000,001 to NPR 100,000,000 | 0.1% of capital | NPR 10,001 | NPR 100,000 |

| Private Limited Company | Above NPR 100,000,000 | Fixed fee | NPR 100,000 | NPR 100,000 |

| Public Limited Company | Up to NPR 10,000,000 | 0.05% of capital | NPR 5,000 | NPR 5,000 |

| Public Limited Company | NPR 10,000,001 to NPR 100,000,000 | 0.05% of capital | NPR 5,001 | NPR 50,000 |

| Public Limited Company | Above NPR 100,000,000 | Fixed fee | NPR 50,000 | NPR 50,000 |

| Foreign Branch Office | Not applicable | Fixed fee | NPR 25,000 | NPR 25,000 |

| Foreign Liaison Office | Not applicable | Fixed fee | NPR 15,000 | NPR 15,000 |

| Non-Profit Company | Any amount | Fixed fee | NPR 5,000 | NPR 5,000 |

How Long Does the Company Registration Process Take?

The company registration process in Nepal typically takes 7 to 15 working days from the date of application submission, provided all documents are complete and accurate.

The Office of Company Registrar requires 3 to 5 working days for name reservation approval. After name approval, document preparation and notarization take 2 to 3 days. Submission and verification of the complete application package require 5 to 7 working days. The OCR issues the company registration certificate within 3 days after approval. Publication in the Nepal Gazette adds another 2 to 3 days. Overall, the timeline for paying company registration fees in Nepal and completing the entire process ranges from 2 to 3 weeks under normal circumstances.

Delays may occur due to incomplete documentation, errors in application forms, or pending clarifications from applicants. Foreign company registrations typically take longer, ranging from 3 to 4 weeks, due to additional verification requirements. Expedited processing is available for an additional fee, reducing the timeline to 5 to 7 working days. Planning adequate time for the registration process ensures timely business commencement.

What Are the Costs Involved in Company Registration?

Company registration fees in Nepal comprise multiple components including government charges, professional fees, and miscellaneous expenses that vary based on company type and capital.

| Fee Category | Description | Amount (NPR) | Remarks |

|---|---|---|---|

| Name Reservation | Name search and approval | 100 – 500 | Valid for 35 days |

| Registration Fee | Based on authorized capital | 1,000 – 100,000 | As per fee structure |

| Nepal Gazette Publication | Mandatory government publication | 600 | Fixed government charge |

| Newspaper Publication | National daily newspaper | 2,000 – 5,000 | Varies by newspaper |

| Certificate Issuance | Company registration certificate | 1,000 | One-time fee |

| Company Seal | Official company seal preparation | 500 – 1,500 | Depends on quality |

| Document Verification | OCR verification charges | 500 | Per application |

| Notarization | Document authentication | 500 per document | Multiple documents required |

| Translation Services | English to Nepali translation | 100 per page | If documents in English |

| Legal Consultancy | Professional documentation support | 15,000 – 50,000 | Varies by complexity |

| PAN Registration | Tax registration | 500 | Mandatory requirement |

| VAT Registration | Value Added Tax registration | 1,000 | If applicable |

| Certified Copies | Additional certificate copies | 200 per copy | Optional |

What Are Post-Registration Requirements?

After completing company registration and paying company registration fees in Nepal, several compliance obligations must be fulfilled to maintain legal status and operational legitimacy.

- PAN Registration: Obtain Permanent Account Number from Inland Revenue Department within 7 days of company registration

- VAT Registration: Register for Value Added Tax if annual turnover exceeds NPR 5,000,000

- Municipal License: Acquire business operation license from local municipal office

- Industry Registration: Register with Department of Industry for manufacturing companies

- Bank Account Opening: Open corporate bank account in company name with registration certificate

- Social Security Registration: Register with Social Security Fund within 30 days of hiring employees

- Labor Office Registration: Register with Department of Labor if employing more than 10 workers

- Annual Return Filing: Submit annual returns to Office of Company Registrar within 6 months of fiscal year end

- Tax Return Filing: File annual income tax returns with Inland Revenue Department

- Board Meetings: Conduct mandatory board meetings as per Articles of Association

- Shareholder Meetings: Hold annual general meetings within 6 months of fiscal year end

- Financial Audit: Conduct statutory audit of financial statements annually

- Renewal of Licenses: Renew municipal and industry licenses annually

- Compliance Certificates: Obtain tax clearance and compliance certificates as required

What Types of Companies Can Be Registered in Nepal?

Different types of companies can be registered in Nepal under the Companies Act, 2063, each with distinct characteristics and company registration fees in Nepal.

| Company Type | Minimum Shareholders | Minimum Directors | Minimum Capital | Liability | Registration Fee Range |

|---|---|---|---|---|---|

| Private Limited Company | 1 | 1 | NPR 100,000 | Limited | NPR 1,000 – 100,000 |

| Public Limited Company | 7 | 3 | NPR 1,000,000 | Limited | NPR 5,000 – 50,000 |

| Company Limited by Guarantee | 2 | 3 | No minimum | Limited | NPR 5,000 |

| Unlimited Company | 2 | 1 | No minimum | Unlimited | NPR 1,000 |

| Foreign Branch Office | Parent company | 1 | As per approval | Parent liable | NPR 25,000 |

| Foreign Liaison Office | Parent company | 1 | No capital | Parent liable | NPR 15,000 |

| Non-Profit Company | 7 | 3 | No minimum | Limited | NPR 5,000 |

| One Person Company | 1 | 1 | NPR 100,000 | Limited | NPR 1,000 – 10,000 |

What Benefits Does Company Registration Provide?

Company registration in Nepal offers numerous legal, financial, and operational advantages that justify the company registration fees in Nepal paid during incorporation.

- Legal Entity Status: Registered companies acquire separate legal personality distinct from shareholders and directors

- Limited Liability Protection: Shareholders’ liability is limited to their share capital contribution

- Perpetual Succession: Company continues to exist regardless of changes in ownership or management

- Access to Formal Finance: Registered companies can obtain bank loans, credit facilities, and institutional funding

- Tax Benefits: Eligible for various tax deductions, exemptions, and incentives under Income Tax Act

- Business Credibility: Registration enhances market reputation and customer confidence

- Contract Capacity: Companies can enter into contracts, own property, and sue or be sued

- Foreign Investment: Registered companies can attract foreign direct investment and technology transfer

- Government Tenders: Eligibility to participate in government procurement and tender processes

- Intellectual Property: Ability to register trademarks, patents, and copyrights in company name

- Employee Benefits: Can provide provident fund, gratuity, and other statutory benefits to employees

- Expansion Opportunities: Easier to expand business through branches, subsidiaries, or franchising

- Exit Options: Shareholders can transfer shares or exit through sale or merger

- Regulatory Compliance: Structured framework for governance and accountability

- International Trade: Facilitates import-export operations and international business transactions

FAQs

How much does it cost to register a company in Nepal?

The total cost of registering a company in Nepal varies depending on the authorized capital and type of company. For a typical private limited company with an authorized capital of NPR 1,000,000, the approximate costs would be:

1. Name reservation fee: –

2. Registration fee: NPR 1,000 – NPR 43,000+

3. Memorandum and Articles of Association fee: –

4. PAN registration fee: –

5. Ward Registration Fees: NPR 7,500 – NPR 40,000

6. Miscellaneous fees: NPR 2,000 – 3,000

Total approximate cost: NPR 10,000 – 50,000 (USD 90 – 450)

Are there different fees for different types of companies?

Yes, there are different fee structures for various types of companies. For example:

1. Private Limited Companies: Follow the standard fee structure based on authorized capital.

2. Public Limited Companies: Generally have higher fees due to larger capital requirements.

3. Non-Profit Organizations: May have reduced fees or different fee structures.

4. Foreign Companies: May have additional fees related to foreign investment approvals.

Can registration fees be paid online?

Yes, the Office of Company Registrar has introduced an online payment system for certain fees. However, not all fees may be payable online, and it’s advisable to check the latest payment options on the OCR website or consult with a registration expert.

Are there any additional fees after the initial registration?

Yes, companies may incur additional fees after initial registration, including:

1. Annual return filing fee

2. Share capital increase fee

3. Amendment of Memorandum and Articles of Association fee

4. Change of company name fee

5. Branch office registration fee

These fees vary depending on the specific requirements and changes made to the company structure.

How often do company registration fees change in Nepal?

Company registration fees in Nepal are subject to periodic review and may change based on government policies and economic factors. While there is no fixed schedule for fee changes, it is common for fees to be reviewed every few years. It is advisable to consult the latest fee schedule published by the Office of Company Registrar or seek professional advice to ensure you have the most up-to-date information on registration fees.

Why Choose Companynp for Company Registration Services?

Companynp stands as the premier and most trusted legal service provider in Nepal for company registration and corporate compliance matters. With over two decades of experience, we have successfully registered thousands of companies across all sectors and business types. Our expert team of corporate lawyers, chartered accountants, and company secretaries provides comprehensive support throughout the registration process, ensuring accurate calculation and timely payment of company registration fees in Nepal.

We offer end-to-end company registration services including name reservation, document preparation, fee calculation, application submission, and post-registration compliance. Our deep understanding of the Companies Act, 2063 and related regulations enables us to navigate complex registration requirements efficiently. We maintain excellent relationships with the Office of Company Registrar, ensuring faster processing and approval of applications.

Our transparent fee structure and competitive pricing make professional company registration services accessible to startups, SMEs, and large corporations alike. We provide detailed cost breakdowns of all company registration fees in Nepal, eliminating hidden charges and financial surprises. Our commitment to client satisfaction, legal accuracy, and timely service delivery has established us as the number one choice for company registration in Nepal. Contact us today for expert guidance on company registration fees in Nepal and comprehensive incorporation services.