This article will guide you through the process of registering an e-commerce company in Nepal, covering everything from the basics to specific requirements as per the new 2025 Act. The Department of Commerce, Supplies and Consumer Protection has also introduced new regulations for Listing of E-Commerce Businesses on 18th of Ashad 2082.

What is an E-commerce Business?

An e-commerce Business is a business that conducts its buying and selling activities primarily through electronic channels, especially the internet. These companies operate virtual storefronts, allowing customers to browse, select, and purchase products or services online.

Please find the DOCSCP Guidelines here:

Key features of e-commerce businesses include:

- Online product catalogs

- Shopping cart systems

- Secure payment gateways

- Digital marketing strategies

- Customer relationship management tools

- Logistics and delivery services

E-commerce businesses can operate in various models, such as Business-to-Consumer (B2C), Business-to-Business (B2B), Consumer-to-Consumer (C2C), or a combination of these. In Nepal, e-commerce companies are transforming the retail landscape, offering convenience and access to a wide range of products to consumers across the country.

Where to Register an E-commerce Company in Nepal?

In Nepal, e-commerce companies are primarily registered with the Office of Company Registrar (“OCR”) and the Department of Commerce, Supplies & Consumer Protection (“DOCSCP”)which falls under the Ministry of Industry, Commerce, and Supplies. To be listed in the Department, the business must be registered as either of the follows:

- Office of Company Registrar (OCR) as a Pvt. Ltd. Company

- DOCSCP as a Private Individual-Owned Firm

- DOCSCP as a Private Jointly-Owned Firm

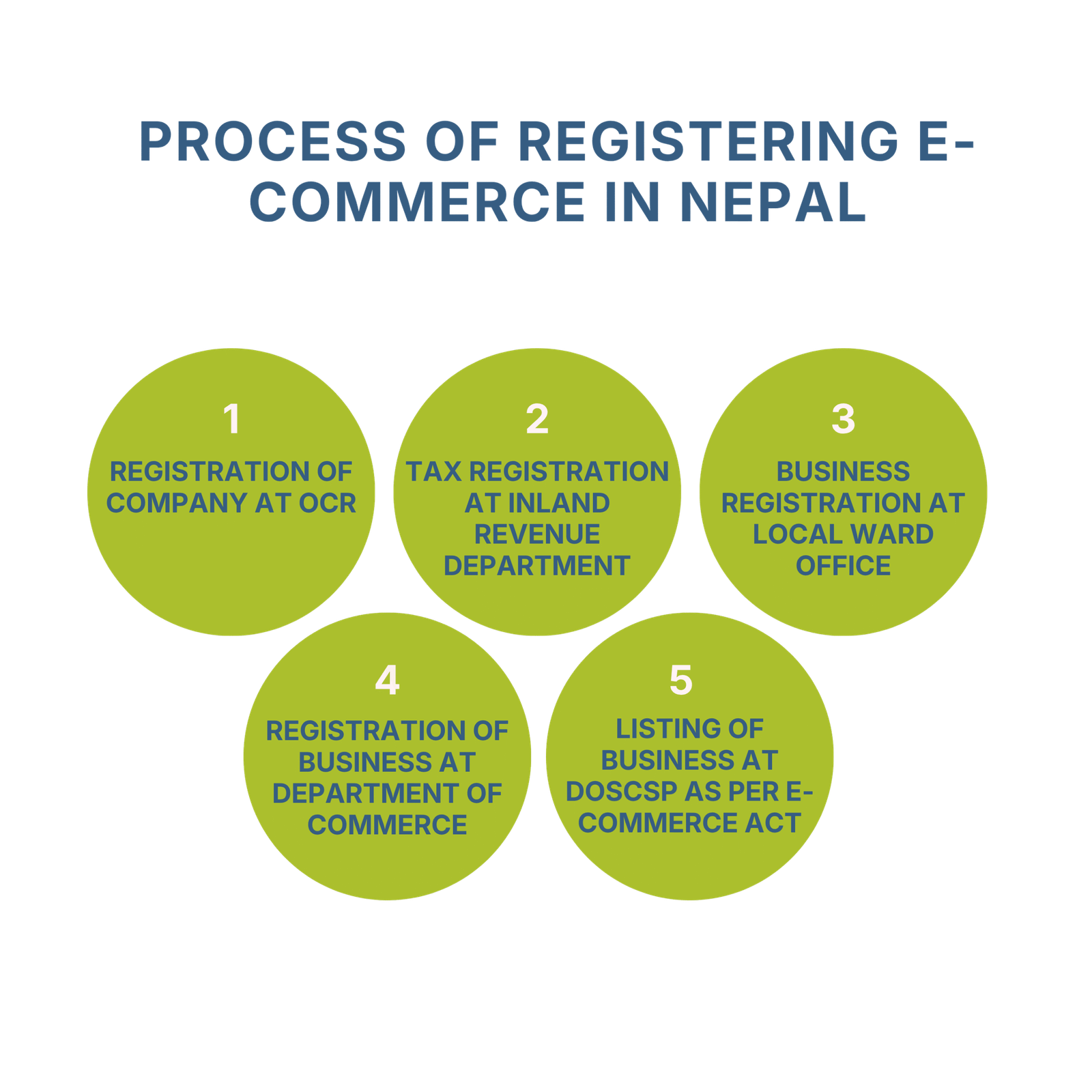

What is the Process of Registering an E-commerce Company in Nepal?

- Step 1: Registration of Company at OCR

- Step 2: Tax Registration at Inland Revenue Department

- Step 3: Business Registration at Local Ward Office

- Step 4: Registration of Business at Department of Commerce (DOCSCP)

- Step 5: Listing of Business at DOSCSP as per E-Commerce Act

Step 1: Registration of Company at OCR

Register your company with the Office of Company Registrar (OCR) to obtain legal identity, registration certificate, and company number required to conduct business activities officially in Nepal.

Step 2: Tax Registration at Inland Revenue Department

After company registration, apply at the Inland Revenue Department to receive a PAN or VAT number. This allows you to legally pay taxes and issue tax invoices.

Step 3: Business Registration at Local Ward Office

Register your business with the local ward office to receive a business operation permit, verify business location, and comply with local government requirements for smooth and legal functioning.

Step 4: Registration of Business at Department of Commerce (DOCSCP)

Submit your documents at the Department of Commerce to receive a business registration certificate required for commercial trade, export-import, and national-level operations under commerce-related legal provisions.

Step 5: Listing of Business at DOSCSP as per E-Commerce Act

List your e-commerce business with DOSCSP to follow the E-Commerce Act. This ensures regulatory compliance, consumer protection, and lawful digital transactions in Nepal’s online marketplace.

This process typically takes 7-15 working days, depending on the completeness of your application and the current workload of the OCR. It’s crucial to ensure all documents are accurate and complete to avoid delays in the registration process.

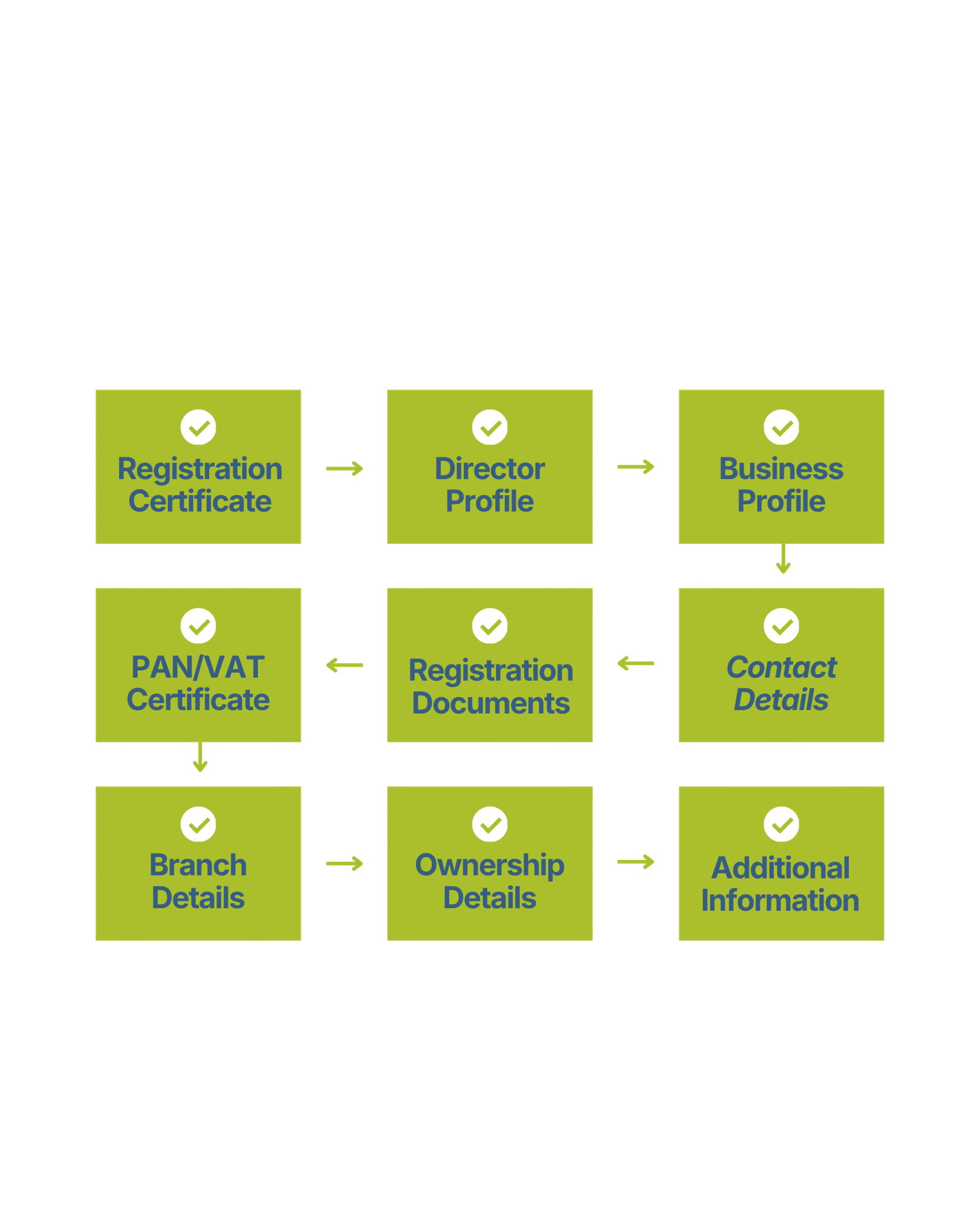

What Documents are Required for Listing as an E-Commerce Business?

The Required Documents for Listing as an E-Commerce Business are:

- Registration certificate of the business (either as a private company or a private firm)

- Name and profile of the directors of the e-commerce business

- Objectives and profile of the e-commerce business

- PAN/VAT number of the e-commerce business along with the registration certificate

- Relevant registration documents of the business

- Telephone number, email, social media links, and contact address of the business

- Number of branches/outlets of the business along with their locations

- Any additional information mentioned on the portal

What details are required to be displayed on a business’s e-commerce platform?

The Details/Information to be displayed on the E-Commerce Platform are:

- Name of the e-commerce platform

- Name, location, registration number, and name of the government entity where the platform is registered

- Registered address, head office, outlets, branches, and their details

- Information on any additional licenses obtained (e.g., DFTQC)

- VAT or PAN registration number

- Customer support email, telephone, and mobile number

- Business email, telephone, mobile number, telefax, and social media links

- Grievance handling officer’s name, email, telephone or mobile number, and official address

- Listing number of the e-commerce portal

How Long Does it Take to get Listed as an E-Commerce Business

The timeline for being listed as an e-commerce company in Nepal can vary depending on several factors but the following timeline can be referred upon:

| Procedure | Estimated Time |

|---|---|

| Registration of Company | 3–5 Days |

| Registration at Tax Office | 1 Day |

| Registration at Ward Office | 1 Day |

| Obtaining Share Registry | 3–5 Days |

| Registration at DOCSCP | 1 Day |

| Listing as E-Commerce Business | 1–2 Days |

Total estimated time: 10-15 Days

What is the Cost of Registering an E-commerce Business in Nepal?

The cost of registering an e-commerce business in Nepal consists of various fees and charges.

| Particulars | Fees / Charges |

|---|---|

| Government Fees at OCR | Starts from NPR 1,000 |

| Government Fees at Local Ward Office | Starts from NPR 5,000 |

| Government Fees at Department of Commerce | Starts from NPR 1,000 |

| Service Charge for Consultants | Depends |

Contact us via Whatsapp/Cell at +977 9709090127 to receive Fee Quotation to register/list E-Commerce Business

What are the Post-Registration Requirements for an E-commerce Business?

After successfully registering your e-commerce company in Nepal, there are several important post-registration requirements to fulfill:

- Annual Compliance/AGM at the Office of Company Registrar

- Submission of Audit Report (for a Pvt. Ltd. Entity) along with Relevant Filings

- Monthly or Quarterly VAT Filings (if registered on VAT)

- Renewal at the Department of Commerce

- Renewal at Local Ward Office.

Read More:

Pollution Control Certificate Process in Nepal

NGO Registration Process in Nepal

Energy Generation License Process in Nepal

Education Consultancy Registration in Nepal

How to register an eCommerce business in Nepal?

1. Choose a unique company name and verify its availability at the Office of the Company Registrar (OCR).

2. Prepare required documents (MoA, AoA, application form, and shareholder details).

3. Submit the application to OCR and obtain a company registration certificate.

4. Register for PAN/VAT at the Inland Revenue Department (IRD).

5. Obtain necessary licenses (e.g., e-commerce trade license, digital payment integration).

6. Comply with Nepal Rastra Bank (NRB) guidelines for online transactions.

Can we register a company online in Nepal?

Yes, Nepal allows online company registration through the Office of the Company Registrar’s e-services portal. The process includes name reservation, document submission, and application tracking. However, physical verification and submission of original documents may still be required in some cases.

What is e-commerce registration?

E-commerce registration is the legal process of establishing an online business, which involves company registration, tax registration (PAN/VAT), and obtaining necessary business licenses. It ensures compliance with Nepalese regulations governing digital commerce and online transactions.

Which eCommerce platform is best in Nepal?

Daraz is Nepal’s largest eCommerce marketplace with strong seller support. SastoDeal is another major platform with diverse products, while HamroBazar offers free classifieds. SmartDoko is growing quickly with a broad product range. Businesses can also create custom online stores using Shopify, Woo Commerce, or Magento.

How much does it cost to register an eCommerce business?

Registering an eCommerce business in Nepal typically costs NPR 20,000–50,000 if you do basic registration, and NPR 50,000–100,000+ if you use professional services. Costs include company registration, PAN/VAT, local ward license, legal documentation, and optional website setup.

Contents

- 1 What is an E-commerce Business?

- 2 Where to Register an E-commerce Company in Nepal?

- 3 What is the Process of Registering an E-commerce Company in Nepal?

- 4 What Documents are Required for Listing as an E-Commerce Business?

- 5 What details are required to be displayed on a business’s e-commerce platform?

- 6 How Long Does it Take to get Listed as an E-Commerce Business

- 7 What is the Cost of Registering an E-commerce Business in Nepal?

- 8 What are the Post-Registration Requirements for an E-commerce Business?